34

BASIC FUNCTION PROGRAMMING

(For Quick Start)

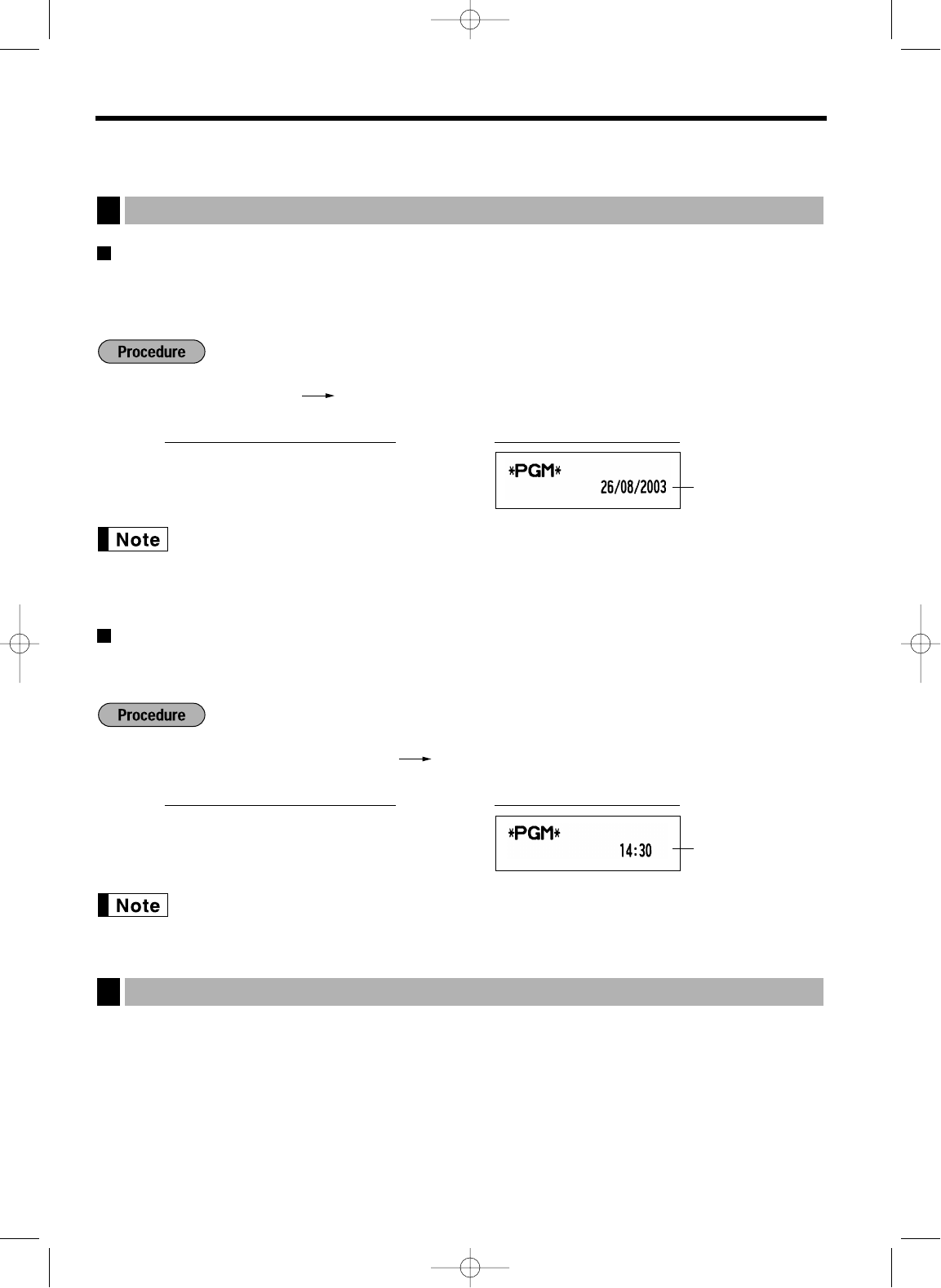

Date

For setting the date, enter the date in 8 digits using the day-month-year (DD/MM/YYYY) format, then press the

N

key.

You can use the date format of month-day-year (MM/DD/YYYY) or year-month-day (YYYY/MM/DD)

format. To change the format, refer to “Various Function Selection Programming 1” section (Job

code 61).

Time

For setting the time, enter the time in 4 digits using the 24-hour format. For example, when the time is set to

2:30 AM, enter 230; and when it is set to 2:30 PM, enter 1430.

In the display, current time is displayed in 24-hour format. If you want to display time in the 12-hour

format, refer to “Various Function Selection Programming 1” section (Job code 61).

If you program the VAT/tax, the cash register can calculate the sales tax. In the VAT system, the tax is included

in the price you enter in the register, and the tax amount is calculated when tendered according to the VAT rate

programmed. In the tax system, the tax is calculated when tendered according to the tax rate programmed, and

added to the price. The cash register can provide totally 6 kinds of VAT/tax systems (automatic VAT1-4,

automatic tax 1-4, manual VAT 1-4, manual VAT 1, manual tax 1-4, and automatic VAT1 and automatic tax 2-4

systems) and 4 kinds of rates. By default, the cash register is pre-programmed as automatic VAT1-4 system.

Tax Programming

2